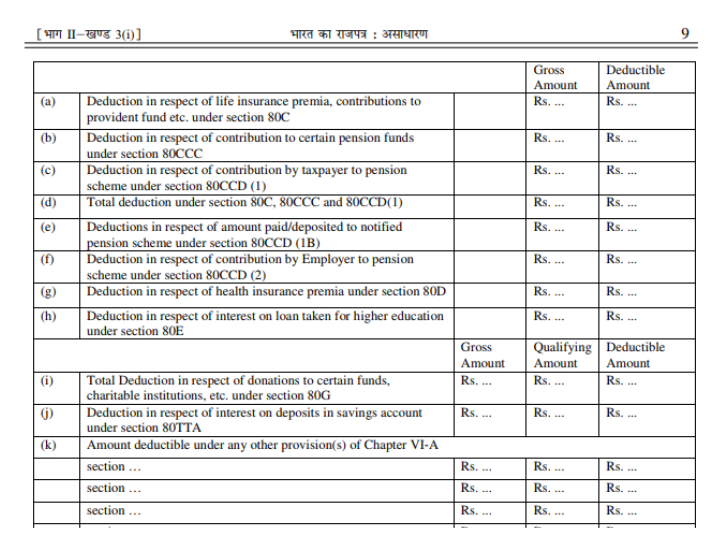

Deduction Under Section 80 C of Income Tax Act with the Automatic Form A16 Part B and A&B ( One by One preparation) For FY 2016-17 – tdstaxindia.net

Deduction from Salary Sec 16 | Deduction from Salary | Section 16 under the head salary| AY 2021-22 - YouTube

Can I Claim Deductions Under Section 80C And Other Sections If I Claim Standard Deduction Under Section 16?

Deductions from Salary | Deduction under section 16 | Standard deduction |Entertainment Allowance - YouTube